Pay your employees on time, manage HR operations, track time, and more with the help of QuickBooks experts!

Whether you need full-service payroll or help running reports, payroll, or more, our dedicated team provides fast, reliable solutions for setup, tax filing, and payroll issues. Contact us 24/7 via phone, chat, or email for personalized support to keep your business running smoothly.

We provide you with automated payroll, tax calculation and filing, and tax payment services! Let’s see how and when you can contact the Intuit experts at QuickBooks ProAdvsiors for help.

Enjoy the Expert Assistance When Running Payroll

Have you failed to run your QuickBooks operations and wondering what to do? Seek help from Intuit experts or ProAdvisors and get assistance with basic operations, or let them handle your business operations!

Connect with an Intuit expert

Here’s how to get in touch with QuickBooks payroll experts:

- Open your QuickBooks payroll.

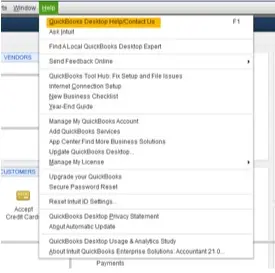

- Navigate to the Help menu.

- Tap on QuickBooks Desktop Help/Contact Us.

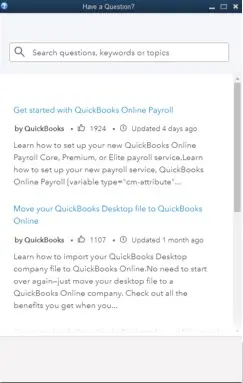

- Enter a query, keyword, or topic you want help with.

- If you can’t find the answers to your questions, click Contact Us to contact QB experts for assistance.

Note- Look for the solution in our detailed article. If the guide isn’t helpful, click the Contact Us option.

Talk to a QB ProAdvisor available 24/7

Let QuickBooks handle the range of payroll functionalities, including automating the payroll process, calculating and filing taxes, managing employee benefits, and integrating with time tracking systems.

We are just a call away to offer guidance on simplifying your business payroll. We are also available to help troubleshoot problems or errors and more.

The team of certified experts at Call Us : +1-888-209-3999 specializes in resolving errors related to opening company files, updating software, and other technical issues, ensuring seamless functionality for your business. Connect with QuickBooks ProAdvisors and enjoy hassle-free payroll operations.

Your Partner for Seamless QuickBooks Payroll Support

As your business partner, we understand the complexity of payroll, tax complaints, and other issues you face in QuickBooks. Our team is dedicated to providing the best and curated services to meet your business needs and different situations.

Payroll processing

Are you new to finance, or do you own a small business? Whatever the case, we can handle the complexities of payroll management as QuickBooks ProAdvisors.

Our team can help you calculate wages, taxes, and deductions, schedule paychecks or direct deposits, and more. QuickBooks Payroll offers features like automatic tax filing and same-day direct deposit.

Tax compliance

No worries about complying with tax laws and regulations!

We are here to correctly report your income expenses and other financial details to the relevant tax authorities. The team helps maintain tax compliance for individuals and businesses so that you can avoid legal consequences and penalties!

Complex pay structures

Do you have a unique pay structure such as commission, overtime, multiple pay rates and need assistance to ensure accurate pay calculations?

We promise accurate tax calculations and compliance, and a tax expert will always be with you. All you need to worry about is payroll operations. We will handle the pay structure while you enjoy peace of mind and focus on growing your business.

Integration issues

Integrating third-party applications with QuickBooks Payroll to streamline various processes.

We are here to help you sync data between QuickBooks Online and QuickBooks desktop or other applications and ensure you enjoy a seamless experience. No more hassles and a seamless workflow!

Run Payroll Seamlessly – Experts Guidance

Experience better payroll management with advanced technology and dedicated commitment from our side! We believe in giving you the best that helps you save time and money, ensure tax compliance to avoid penalties and pay your employees on time. Choose us for reliable, complete QuickBooks payroll services tailored to your needs and ensure better personal and business financial management.

Your Business, Our Services – Better Payroll Management!

Frequently Asked Questions

Connect with QuickBooks ProAdvisors at +1-888-209-3999 to enjoy advanced QuickBooks payroll services. These services include setting up payroll features, direct deposit, and payroll to employees on time, as well as running relevant payroll reports. You can also get help with technical issues and troubleshooting.

The QuickBooks payroll support team can help with various payroll-related issues, including streamlining payday, managing HR, tracking time, and providing benefits to the team. They also help calculate, file, and pay payroll taxes, automate payroll, and improve accuracy.

Yes, QuickBooks experts can help you manually migrate from QuickBooks Desktop Payroll to QuickBooks Online Payroll or using a data migration tool. All you need to do is connect with a QuickBooks expert and ask for help with data migration, or let them do it for you!

Yes, you can view articles or guides on our website or contact an expert to provide a resource sheet. QuickBooks also offers a range of resources including videos, guided help, a dedicated resource library, and options for expert review and customized setup.

Yes, you can outsource QuickBooks ProAdvisors to handle or run payroll for your business. Explore different service providers and see what suits you best. You can compare the services they offer, pricing, and more.

QuickBooks payroll experts can help with various payroll tasks, from basic payroll processing to more complex areas such as tax compliance and integration with other financial software. They can assist with payroll setup, tax filing, and employee benefits, ensuring accurate and efficient payroll management.